How Tidspension works

Tidspension differs from other savings products. As a customer, you have two accounts: one for your contributions and one for your investment return.

Tidspension differs from other savings products. As a customer, you have two accounts: one for your contributions and one for your investment return.

You can shorten or extend the term of your Tidspension agreement, without any effect on your Pensionskonto (pension account) or Bufferkonto (buffer account).

Your Tidspension consists of two accounts: a pension account (P account) and a buffer account (B account). If you shorten or extend the term of your pension scheme, the amount in your P account and your B account, respectively, will not be affected. Your savings will be invested with due consideration to the new retirement age/and or payout schedule.

If you change pension provider and choose another savings product than Tidspension, or if you want to have your savings paid out, we will calculate your savings as the sum of the amounts in your P account and your B account.

This means that if the amount in your B account is negative on the date when you terminate the product, we will offset the balance of your B account against your P account. We will also do so if you have a Tidspension scheme with guarantee.

A Tidspension scheme with guarantee ensures that the annual return on your P account will never be negative.

Tidspension is a unit-linked product, in which the return is determined by investment market developments. With a guarantee, you protect yourself against the amount in your P account being reduced in years with negative investment returns.

With a Tidspension scheme with guarantee, you are guaranteed that you will not have a negative annual return on your P account during either the savings period or the payout period. Each year on 31 December, we make up the total annual return on your P account. We do this by adding up all monthly returns. If the amount is negative, the guarantee is activated, which means that a proportion of the negative amount is transferred back to the B account. Danica will pay the remainder. The closer you are to retirement, the larger the portion of the guarantee transfer will be paid by Danica.

The guarantee costs 0.5 percent of the annual amount in the P account.

During the payout period, you are also guaranteed an annual minimum payout from your annuity pension and life annuity. The guaranteed minimum payout is determined when you retire.

Despite the guarantee, the amount in your P account may be reduced during a calendar year due to expenses, payment for the guarantee, payouts and risk premium deductions.

Your amount of pension benefits depends on the balance of your P account. The amount in your B account is used to calculate the future adjustment of pension benefits.

Your benefits will be paid from your P account. Even though pension contributions are no longer made, we will continue to invest your savings to give you a return. Just as during the savings period, your total return will be placed in your B account. The monthly ‘transfer’ of your return from your B account to your P account will also continue as during the savings period.

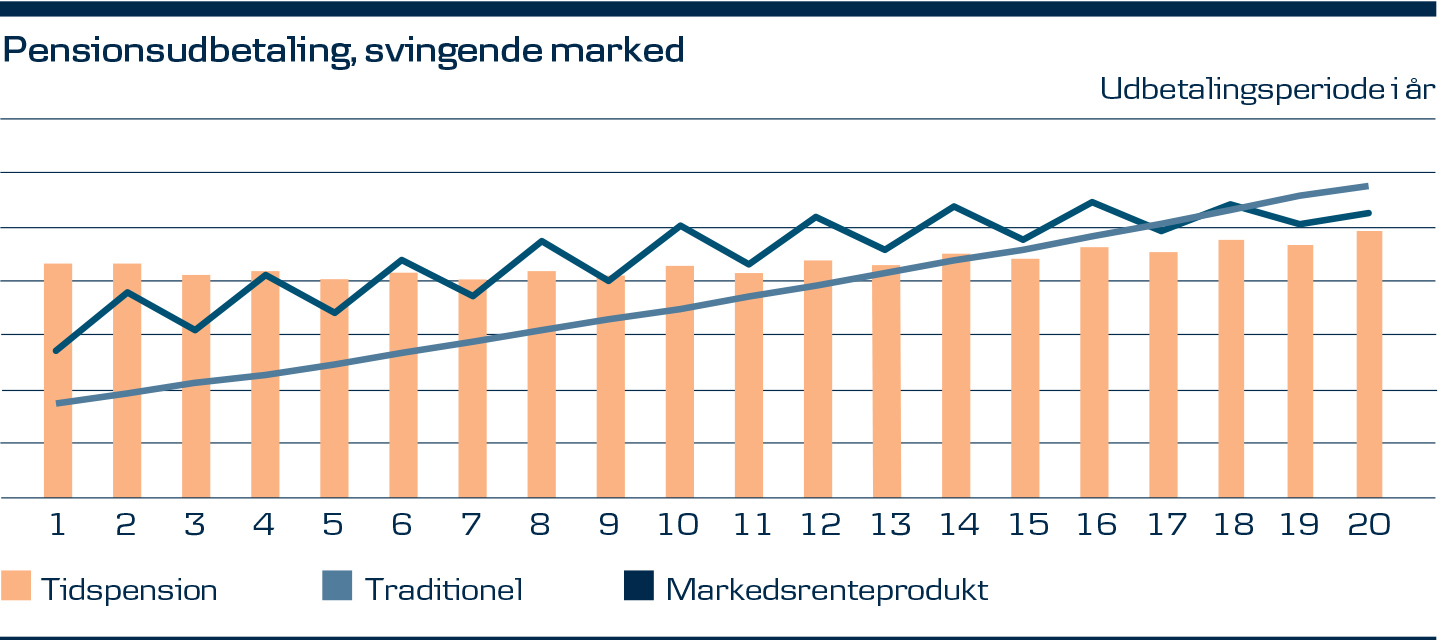

Tidspension’s special equalisation mechanism ensures that your pension benefits are as stable as possible throughout the payout period. Your P account will still receive a stable return from your B account even though investment returns fluctuate from one year to the next. That way, you will receive stable benefits in retirement. In a volatile market where benefits from other unit-linked products fluctuate by up to 10% from one year to the next, Tidspension benefits will typically fluctuate only by up to 2%.

The basis of calculation of benefits is determined based on two assumptions:

By applying these assumptions, we ensure that you will receive more money at the beginning of your retirement than if you choose another pension product with regular benefits.

The basis on which benefits are calculated is determined when you retire and is subsequently fixed and cannot be changed while you are receiving pension benefits. However, it may be changed and may affect you if you are not yet receiving pension benefits.

Your amount of pension benefits is adjusted annually. The amount may increase or decrease according to the development in your P account.

If the development in your P account exactly corresponds to the assumed 2.5%, your benefits for the coming year remain unchanged. If the return is higher than 2.5%, your monthly benefits will also increase. On the other hand, you will receive a lower amount of benefits if the return on your P account is lower than the assumed 2.5%.

Changes to the expected longevity also affect the amount of life annuity benefits.

Your Tidspension consists of two accounts. One for your contributions and one for your annual return.

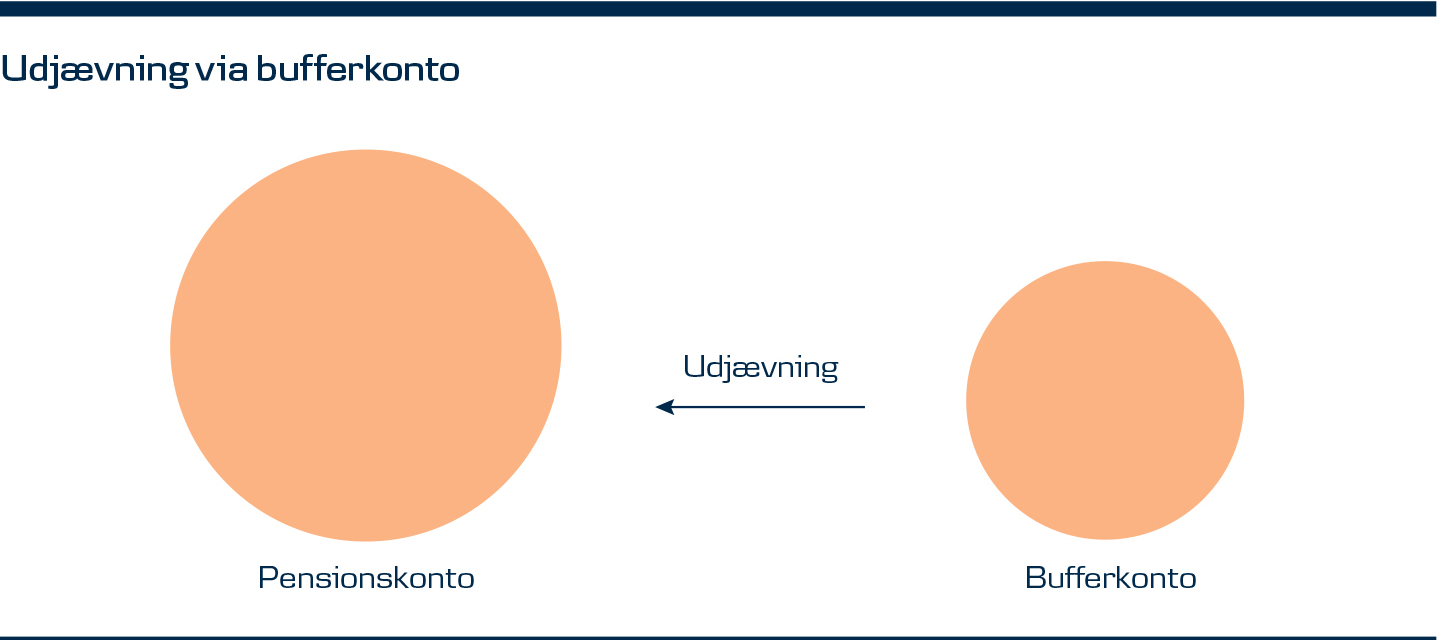

The pension account determines the amount of pension benefits. Even though investment returns fluctuate from one year to the next, a transfer from the buffer account ensures that your pension benefits are more stable.

Every month, an amount is transferred from your buffer account to your pension account. A number of mathematical formulas determine how the amount is calculated – that is what return you get on your pension account. This takes place in two stages:

The buffer account is used for the return that Danica achieves on your savings. Every month, we transfer a portion of the buffer account to the pension account. The remaining amount in the buffer account will act as a buffer at times when investment market returns fluctuate. That way, the return is equalised, as years with negative returns can often be offset against previous years with positive returns.

As your total return can be

either positive or negative, the balance of the buffer account and the total amount transferred from the buffer

account to the pension account can be positive or negative.

If you have a Tidspension scheme with guarantee, you ensure that the annual interest accrued on your pension account

will never be negative.

.

Content is loading

Content is loading